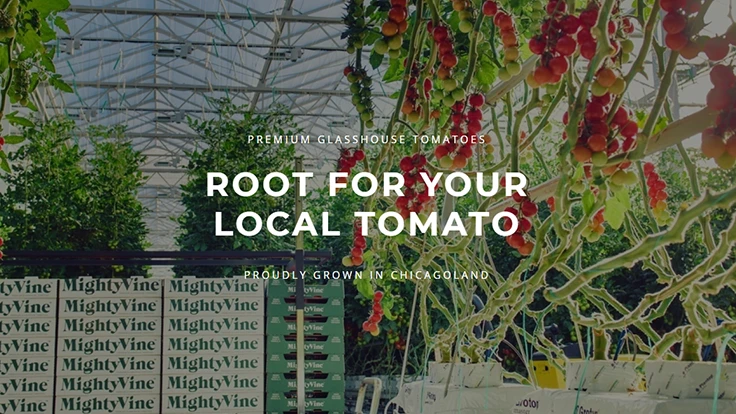

MightyVine, a local grower of hydroponic tomatoes, has secured bank financing for a major greenhouse expansion as it strives to meet rising demand from restaurants and retailers.

The deal with Rabo AgriFinance, a U.S. subsidiary of the Netherlands’ Rabobank, is significant because many commercial banks are reluctant to finance the nascent greenhouse industry, driving startups to take high-interest loans or give up equity to venture capitalists, MightyVine executives said Thursday.

“There’s a lot of very expensive money out there, but it makes it very hard for a young business to succeed if you’re borrowing money that's two, three times the typical rates of commercial banks,” said CEO Gary Lazarski. “We’ve been able to secure financing to double in size at much more traditional rates.”

MightyVine, founded in 2015, plans to double its greenhouse footprint in Rochelle, Ill., from 15 acres to 30 acres by next year. The company may have to nearly double its workforce of 80 employees as well to accommodate increased production of its year-round tomato crop, said Danny Murphy, head of sales and son of MightyVine Chairman Jim Murphy, whose investment firm, Grow Forward, backs the company.

Latest from Produce Grower

- The Growth Industry Episode 10: State of the Horticulture Industry

- Bimi Baby Broccoli partners with Cal-Organic Farms

- Millennium Pacific Greenhouses launches California Grown Cucumber Program

- Scientists develop vitamin A-enriched tomato to fight global deficiency

- UTIA and UT Knoxville research teams will develop automated compost monitoring system

- [WATCH] Advances in growing media for CEA production

- [WATCH] Taking root: The green industry’s guide to successful internships

- Award winners announced for 2026 PHS Philadelphia Flower Show